trump cryptocurrency

Trump cryptocurrency

In a filing on Thursday, 18 states, along with the DeFi Education Fund, issued a lawsuit against the Securities and Exchange Commission, alleging that the regulator’s crackdown on the crypto industry has been unlawful and unconstitutional.< best tactical g shock /p>

The crypto market has been red-hot lately. Any major crypto name that isn’t a stablecoin posted significant gains in the last month. As of this writing, Bitcoin (BTC -1.61%) has gained 43% in 30 days while Cronos (CRO 5.40%) more than doubled and Dogecoin (DOGE -5.36%) more than tripled.

Met de mogelijke veranderingen op het politieke en regelgevende toneel in de Verenigde Staten, heeft Ripple in 2025 alle kansen om een nieuwe groeifase in te gaan. De introductie van een nieuwe SEC-voorzitter, een mogelijke XRP-ETF en de lancering van een eigen stablecoin zijn slechts enkele factoren die Ripple en XRP in de schijnwerpers zetten. Het komende jaar belooft dan ook een spannende periode te worden voor het blockchainbedrijf en zijn community.

I believe investors that are bullish on XRP and that have a much higher risk tolerance are the only ones that should consider buying this cryptocurrency right now, particularly as part of a well-diversified portfolio. However, I’m not one of those investors.

Currently, XRP is one of the more popular cryptocurrencies, and there is a regular demand for the coin. However, a number of factors need to be taken in consideration when investing in cryptocurrency. Investing at the right moment can make a big difference, so staying in touch with all the latest events can be extremely important.

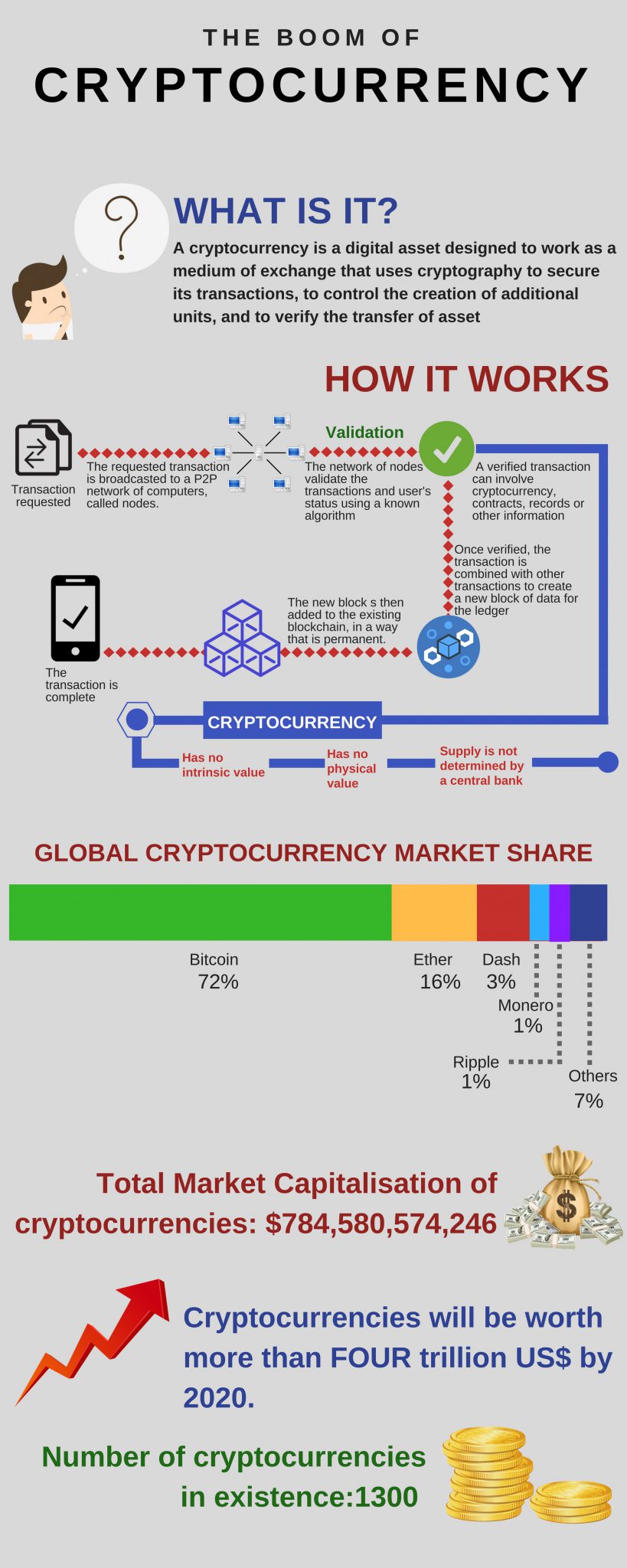

How does cryptocurrency work

The remittance economy is testing one of cryptocurrency’s most prominent use cases. Cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders. Thus, a fiat currency is converted to Bitcoin (or another cryptocurrency), transferred across borders, and subsequently converted to the destination fiat currency without third-party involvement.

Buying and selling cryptocurrencies has become a very big business. The total value of all the cryptocurrencies in the world is more than $1,4 trillion. You can trade online with crypto exchanges like Binance, KuCoin, and Kraken. You can also arrange to trade cryptocurrencies in person, with Peer-to-Peer sites like LocalBitcoins.

The remittance economy is testing one of cryptocurrency’s most prominent use cases. Cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders. Thus, a fiat currency is converted to Bitcoin (or another cryptocurrency), transferred across borders, and subsequently converted to the destination fiat currency without third-party involvement.

Buying and selling cryptocurrencies has become a very big business. The total value of all the cryptocurrencies in the world is more than $1,4 trillion. You can trade online with crypto exchanges like Binance, KuCoin, and Kraken. You can also arrange to trade cryptocurrencies in person, with Peer-to-Peer sites like LocalBitcoins.

Because there are so many cryptocurrencies on the market, it’s important to understand the types. Knowing whether the coin you’re looking at has a purpose can help you decide whether it is worth investing in—a cryptocurrency with a purpose is likely to be less risky than one that doesn’t have a use.

What is cryptocurrency mining? People who are running software and hardware aimed at confirming transactions to the digital ledger are cryptocurrency miners. Solving cryptographic puzzles (via software) to add transactions to the ledger (the blockchain) in the hope of getting coins as a reward is cryptocurrency mining.

Trading cryptocurrency

A cryptocurrency’s tokenomics are of paramount importance, as they determine the cryptocurrency’s total supply, distribution, and its incentive mechanisms. These are factors that often have a direct impact on the cryptocurrency’s price movements.

If you own $10,000 worth of Bitcoin and want to hedge against a possible decrease in its price, you could buy a put option for a premium of $500 that gives you the right to sell bitcoin at $50,000 at a future date. If Bitcoin’s price falls to $40,000, you can exercise your option and sell your bitcoin for $50,000, significantly reducing your losses.

Selecting a reliable cryptocurrency exchange is critical. A good guideline is to opt for an exchange with a proven long-term track record, an excellent reputation, strong security protocols, and responsive customer support.

A cryptocurrency’s tokenomics are of paramount importance, as they determine the cryptocurrency’s total supply, distribution, and its incentive mechanisms. These are factors that often have a direct impact on the cryptocurrency’s price movements.

If you own $10,000 worth of Bitcoin and want to hedge against a possible decrease in its price, you could buy a put option for a premium of $500 that gives you the right to sell bitcoin at $50,000 at a future date. If Bitcoin’s price falls to $40,000, you can exercise your option and sell your bitcoin for $50,000, significantly reducing your losses.

Selecting a reliable cryptocurrency exchange is critical. A good guideline is to opt for an exchange with a proven long-term track record, an excellent reputation, strong security protocols, and responsive customer support.