cryptocurrency market cap

Cryptocurrency market cap

Cryptocurrency exchanges play a crucial role in the trading and pricing of cryptocurrencies like Pi Network. They serve as platforms where buyers and sellers meet to trade crypto. cons of electing judges The prices of cryptocurrencies are determined by the buying and selling activity within these exchanges

Developed by a group of Stanford University alumni, Pi Network focuses on building a decentralized peer-to-peer ecosystem. The project’s goal is to create an inclusive network where users can mine Pi coins effortlessly by tapping an app button once a day. This approach eliminates the need for substantial computing power or staking, distinguishing it from many other cryptocurrencies.

Pi Network is currently operating on a testnet, with plans to launch the open mainnet by the end of 2024, although no official release date has been confirmed. The mainnet will introduce the ability for Pi Coins (PI) to be exchanged for other digital assets or fiat currencies. Recent updates, such as the release of Testnet 2, have improved transaction efficiency and reduced fees to 0.0000099 Pi. Despite widespread interest and millions of users mining Pi coins, the currency’s future market value remains uncertain.

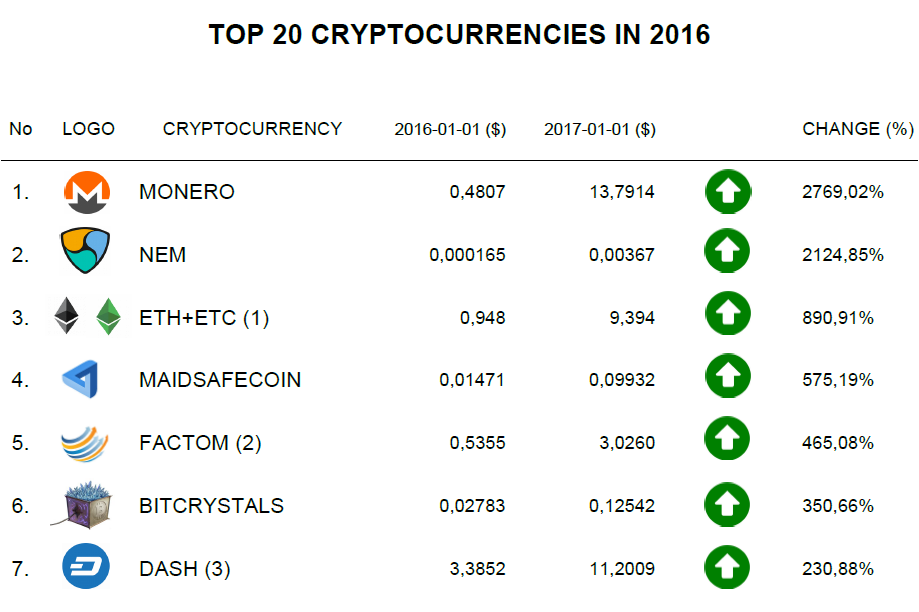

Top 10 cryptocurrency

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

Die basis staat nog steeds als een huis. Ethereum is één van de weinige coins die het jarenlang op rij lukt de top 3 te delen met bitcoin. Naast bitcoin lijkt Ethereum dus een veilige keuze voor de lange termijn.

Ethereum is inmiddels uitgegroeid tot ‘ the steady runner-up’. ofwel de vaste nummer 2 in crypto. De groei wordt naar verwachting doorgezet door een snelle adoptie van bedrijven van deze munt. Een hooggenoteerde in dit rijtje, met een marktwaarde van 39 miljard. De cryptocoin is ontwikkeld door de jonge Vitalik Buterin en is vooral onder de belangstelling vanwege het achterliggende systeem. De transacties kunnen namelijk geautomatiseerd worden door de zogenaamde Smart Contracts. Meer over Ethereum

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

In de groeiende wereld van metaverse-concepten en virtuele evenementen, kan MANA een belangrijke rol gaan spelen in het creëren van een decentraal ecosysteem voor virtuele activa en diensten. Dit ecosysteem omvat alles: van virtuele vastgoedontwikkeling, handel in digitale items en kunstgalerieën tot virtuele casino’s en interactieve ervaringen. Dit maakt het Decentraland-platform klaar voor de toekomst.

Tether is de crypto variant van de Amerikaanse Dollar. De afkorting zegt het eigenlijk al. USDT staat namelijk voor United States Dollar Tether. Het is een zeer stabiele munt en is daarmee een unicum in de wilde wereld van de sterk fluctuerende waardes. Dat is nou precies de kracht van Tether. Veel handelaren gebruiken Tether als wisselvaluta. Wil je jouw geld even veilig wegzetten, bijvoorbeeld omdat er sprake is van sterke dalingen of je even een handelspauze inlast? Kies dan voor USDT. De munt volgt ook de koers van de ‘echte’ Dollar.

Cryptocurrency market

There are also purely technical elements to consider. For example, technological advancement in cryptocurrencies such as bitcoin result in high up-front costs to miners in the form of specialized hardware and software. Cryptocurrency transactions are normally irreversible after a number of blocks confirm the transaction. Additionally, cryptocurrency private keys can be permanently lost from local storage due to malware, data loss or the destruction of the physical media. This precludes the cryptocurrency from being spent, resulting in its effective removal from the markets.

From day one, ensuring an exceptional user experience was a pillar of our product goals. All our services strive to provide straightforward navigation presented through a simple, clear structure. Over the years, we’ve continued to refine and further streamline our services to crystalize peak performance. Right now, eligible users can buy, sell, swap, and store crypto in just a few clicks.

As for mining Bitcoins, the process requires electrical energy. Miners solve complex mathematical problems, and the reward is more Bitcoins generated and awarded to them. Miners also verify transactions and prevent fraud, so more miners equals faster, more reliable, and more secure transactions.

Throughout its ten years of operation, CEX.IO has set itself apart by offering Bitcoin traders and cryptocurrency enthusiasts access to high-quality markets with appropriate liquidity levels. We believe that an intuitive, user-friendly interface combined with advanced trading instruments, and backed by world-class security is the perfect tool for navigating the crypto ecosystem.

In 2021, 17 states in the US passed laws and resolutions concerning cryptocurrency regulation. This led the Securities and Exchange Commission to start considering what steps to take. On 8 July 2021, Senator Elizabeth Warren, part of the Senate Banking Committee, wrote to the chairman of the SEC and demanded answers on cryptocurrency regulation due to the increase in cryptocurrency exchange use and the danger this posed to consumers. On 5 August 2021, the chairman, Gary Gensler, responded to Warren’s letter and called for legislation focused on “crypto trading, lending and DeFi platforms,” because of how vulnerable investors could be when they traded on crypto trading platforms without a broker. He also argued that many tokens in the crypto market may be unregistered securities without required disclosures or market oversight. Additionally, Gensler did not hold back in his criticism of stablecoins. These tokens, which are pegged to the value of fiat currencies, may allow individuals to bypass important public policy goals related to traditional banking and financial systems, such as anti-money laundering, tax compliance, and sanctions.